child tax credit portal not working

Your amount changes based on the age of your children. The payment for children.

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters

Child Tax Credit amounts will be different for each family.

. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income. Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021. How the Child Tax Credit Will Affect Your 2021 Taxes Find.

Youll be given the option of creating a new IDme account or signing in to. How much is the child tax credit worth. Enter your information on Schedule 8812 Form 1040.

IRS Tool Description Non-filer Free Fillable Forms. If you are someone who has little to no income youre under no obligation to file a Federal tax return. Visit the Your Online Account page on the IRS website and click the button marked Sign in to your online account.

New 2021 Child Tax Credit and advance payment details. 1 in 10 Eligible Families Did Not Receive Child Tax Credit Payments. If youve filed tax returns for 2019 or 2020 or if you signed up with the Non-Filer tool last year to receive a stimulus check from the Internal Revenue Service you will get the monthly Child Tax.

You do not have to be working to claim Child Tax Credit. You can no longer elect to receive 50 of your due Child Tax Credit during 2021. In the personal Info section for the dependent you must select answers that indicate that heshe is your dependent child.

For a copy of this leaflet go to wwwhmrcgovukleafletswtc_appdf If you do not have access to the internet phone the Tax Credit Helpline on 0345 300 3900 for more information. If you cannot apply for Child Tax Credit you can apply for Universal Credit instead. The Child Tax Credit is intended to offset the many expenses of raising children.

The IRS has commissioned a third-party verification site IDme to verify your identity before you are. Some taxpayers have been. Youve entered something wrong.

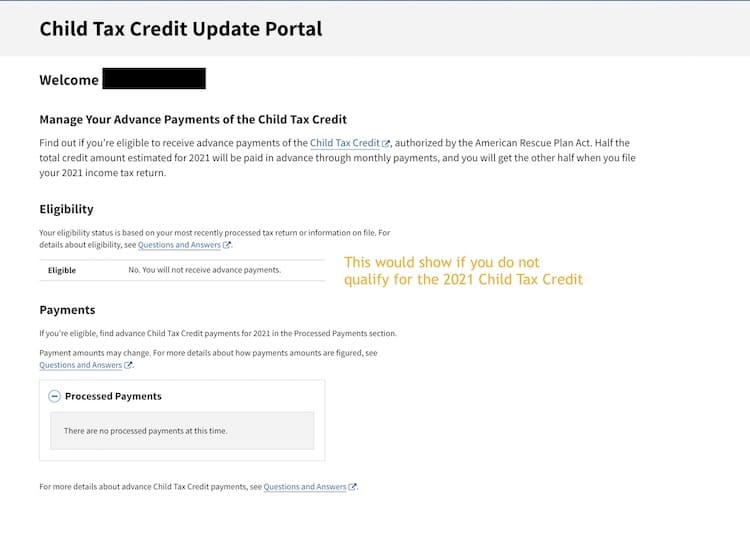

The new Child Tax Credit Update Portal allows parents to view their eligibility view their expected CTC advance payments and if they wish to do so unenroll from receiving advance payments ie to opt out. If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit there can be. What To Do If The IRS Child Tax Credit Portal Isnt Working Finding the portal.

Before 2021 the credit was worth up to 2000 per eligible child and 17 year-olds were not eligible for the credit. These people can now use the online tool to register for monthly child tax credit payments. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Major tax relief for nearly all working families. The IRSs child tax credit portal looks like crap and its not really usable for low-income Americans trying to get 300 monthly federal. You will need to claim 100 of the credit in 2022 by filing a 2021 Return.

Maybe 6 in your case. If you think your Child Tax Credit or Working Tax Credit is wrong contains more information on this. There are 6 possible reasons.

Consider creating an IDme account as the IRS will begin requiring this to access an IRS account beginning in summer of 2022. If the child tax credit update portal and your IRS online account show that you were issued a payment that you did not actually receive. The Child Tax Credit in the American Rescue Plan provides the largest child tax credit.

To complete your 2021 tax return use the information in your online account. To reconcile advance payments on your 2021 return. The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC.

You arent getting the Child Tax credit CTC. For Tax Years 2018-2020 the maximum refundable portion of the credit is 1400 equal to. Child Tax Credit Changes.

And towards the end of this post we will walk through step-by-step what you need in order to. The IRS said it will open a child tax credit portal by July 1 that will let you manage parts of your payment such as whether you want to receive monthly payments through the end of. Report actual income from self-employment if you estimated it when you renewed the deadline is 31 January tell HM Revenue and Customs HMRC about.

How It Works Use this tool to review a record of your. On the other hand you can still file your taxes if you want to. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021.

If you paid taxes in 2019 or 2020 then the portal you will use is here. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17. Do not use the Child Tax Credit Update Portal for tax filing information.

You can only make a claim for Child Tax Credit if you already get Working Tax Credit. Filemytaxes November 30 2021 Child Tax Credit Tax Credits. Use this service to.

Millions of Americans dont care when the tax season begins or ends because they dont have to file taxes. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly. 3000 to 3600 per child for nearly all working families.

Manage your tax credits. In other words a lengthy process where you have to request a custom document be provided. Get your advance payments total and number of qualifying children in your online account.

The payment for children. Your amount changes based on the age of your children. Eligibility Bank account and mailing address Processed payments What You Need.

You can also refer to Letter 6419.

2021 Child Tax Credit Steps To Take To Receive Or Manage

Childctc The Child Tax Credit The White House

Scam Alert Child Tax Credit Is Automatic No Need To Apply Oregonlive Com

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

2021 Child Tax Credit Advanced Payment Option Tas

August Child Tax Credit Payments Issued Here S Why Yours Might Be Delayed Wgn Tv

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

2021 Child Tax Credit Steps To Take To Receive Or Manage

New Child Tax Credit Tool Makes It Easier To Sign Up For Payments Here S How Nextadvisor With Time

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Here S What You Need To Know About Child Tax Credit Payments The Washington Post

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News